What is the Cost Leadership Strategy?

Definition

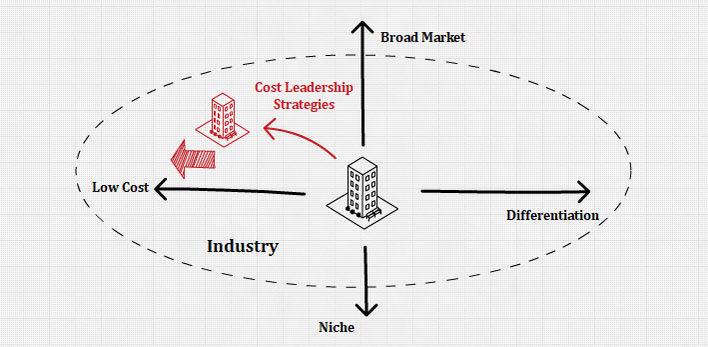

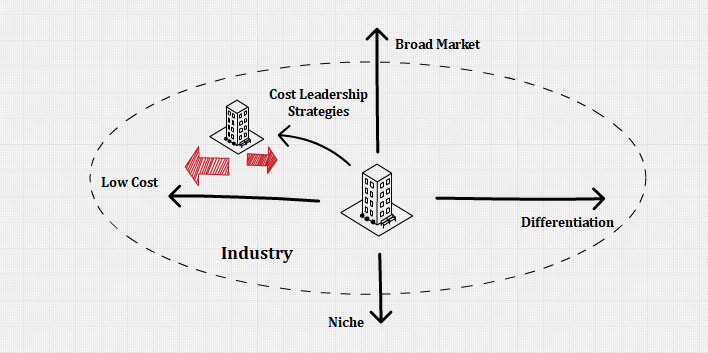

The cost leadership strategy is an integrated set of actions taken to produce goods or services with features that are acceptable to customers at the lowest cost, relative to that of competitors.

Reasons to Use This Strategy

Effective use of the cost leadership strategy allows a firm to earn above-average returns in spite of the presence of strong competitive forces.

Objectives of This Strategy

A company’s goal in pursuing a cost-leadership strategy is to outperform competitors by doing everything it can to produce goods or services at a cost lower than those competitors.

Cost Leadership also Requires Differentiation

It is tempting to think of cost leaders as companies that sell inferior, poor-quality goods and services for rock-bottom prices.

However, a firm following a cost leadership strategy offers products or services with acceptable quality and features to a broad set of customers at a low price.

Firms using the cost leadership strategy commonly sell standardized goods or services, but with competitive levels of differentiation, to create value for the industry’s most typical customers.

The cost leader chooses a low to moderate level of product differentiation. Differentiation is expensive; if the company expends resources to make its products unique, then its costs rise.

The cost leader aims for a level of differentiation not markedly inferior to that of the differentiator (a company that competes by spending resources on product development), but a level obtainable at low cost.

The cost leader does not try to be the industry leader in differentiation. It should wait until customers want a feature or service before providing it.

Advantages and Disadvantages of Cost Leadership

Advantages

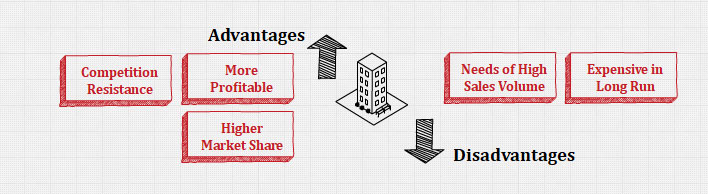

Three advantages accrue from a cost-leadership strategy.

First, because the company has lower costs, it will be more profitable than its closest competitors, which are the companies that compete for the same set of customers and charge similar low prices for their products. If companies in the industry charge similar prices for their products, the cost leader still makes a higher profit than its competitors because of its lower costs.

Second, cost leaders’ emphasis on efficiency makes them well-positioned to withstand price competition from rivals. If rivalry within the industry increases and companies start to compete on price, the cost leader will be able to withstand competition better than the other companies because of its lower costs.

Third, in many settings, cost leaders attract a large market share because a large portion of potential customers finds paying low prices for goods and services of acceptable quality to be very appealing. The need for efficiency means that cost leaders’ profit margins are often slimmer than the margins enjoyed by other firms. However, cost leaders’ ability to make a little bit of profit from each of a large number of customers means that the total profits of cost leaders can be substantial.

For both of these reasons, cost leaders are likely to earn above-average profits. How does a company become the cost leader? It achieves this position by means of the product/market/distinctive-competency choices that it makes to gain a low-cost competitive advantage.

Disadvantages

The principal dangers of the cost-leadership approach arise when competitors are able to develop new strategies that lower their cost structure and beat the cost leader at its own game. For instance, if a technological change makes experience curve economies obsolete, new companies may apply lower-cost technologies that give them a cost advantage over the cost leader. Competitors may also draw a cost advantage from labor-cost savings.

Competitors’ ability to imitate the cost leader’s methods is another threat to the cost-leadership strategy.

Also, the cost-leadership strategy carries a risk that the cost leader, in its single-minded desire to reduce costs, may lose sight of changes in customers’ tastes. Thus, a company might make decisions that decrease costs but drastically affect demand for the product.

The cost leader cannot abandon product differentiation and even low-priced products.

In some settings, the need for high sales volume is a critical disadvantage of a cost leadership strategy. Highly fragmented markets and markets that involve a lot of brand loyalty may not offer much of an opportunity to attract a large segment of customers. A related concern is that achieving a high sales volume usually requires significant upfront investments in production and/or distribution capacity. Not every firm is willing and able to make such investments.

Cost leaders tend to keep their costs low by minimizing advertising, market research, and research and development, but this approach can prove to be expensive in the long run. A relative lack of market research can lead cost leaders to be less skilled than other firms at detecting important environmental changes. Meanwhile, downplaying research and development can slow cost leaders’ ability to respond to changes once they are detected. Lagging rivals in terms of detecting and reacting to external shifts can prove to be a deadly combination that leaves cost leaders out of touch with the market and out of answers.

Cost Leadership Strategy in Five Force Model

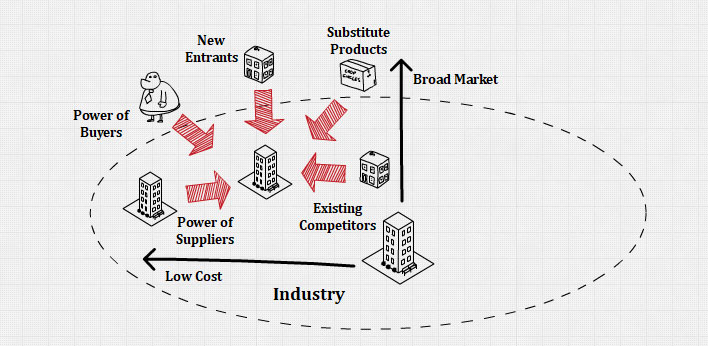

The advantages of each generic strategy are best discussed in terms of Porter’s five forces model. The five forces are threats from competitors, powerful suppliers, powerful buyers, substitute products, and new entrants.

The cost leader is protected from industry competitors because it has a lower cost structure. Its lower costs also mean that it will be less affected than its competitors by increases in the price of inputs if there are powerful suppliers and less affected by the lower prices it can charge for its products if powerful buyers exist.

Moreover, because cost leadership usually requires a big market share, the cost leader purchases in relatively large quantities, increasing its bargaining power over suppliers. If substitute products start to come into the market, the cost leader can reduce its price to compete with them and retain its market share.

Finally, the leader’s cost advantage constitutes a barrier to entry, because other companies are unable to enter the industry and match the leader’s low costs or prices. The cost leader is therefore relatively safe as long as it can maintain its cost advantage, and the price is the key for a significant number of buyers.

Rivalry with Existing Competitors

Having a low-cost position is valuable when dealing with rivals. Because of the cost leader’s advantageous position, rivals hesitate to compete on the basis of price, especially before evaluating the potential outcomes of such competition.

The degree of rivalry present is based on a number of different factors such as the size and resources of rivals, their dependence on the particular market, and location and prior competitive interactions, among others.

Firms may also take actions to reduce the amount of rivalry that they face. Firms sometimes form joint ventures to reduce rivalry and increase the amount of profitability enjoyed by firms in the industry.

Bargaining Power of Buyers

Powerful customers can force a cost leader to reduce its prices, but not below the level at which the cost leader’s next-most-efficient industry competitor can earn average returns.

Although powerful customers might be able to force the cost leader to reduce prices even below this level, they probably would choose not to do so. Prices that are low enough to prevent the next-most-efficient competitor from earning average returns would force that firm to exit the market, leaving the cost leader with less competition and in an even stronger position.

Customers would thus lose their power and pay higher prices if they were forced to purchase from a single firm operating in an industry without rivals. In some cases, rather than forcing firms to reduce their prices, powerful customers may pressure firms to provide innovative products and services.

Buyers can also develop a counterbalancing power to the customers’ power by thoroughly analyzing and understanding each of their customers. To obtain information and understand the customers’ needs, buyers can participate in customers’ networks. In so doing, they share information, build trust, and participate in joint problem solving with their customers. In turn, they use the information obtained to provide a product that provides superior value to customers by most effectively satisfying their needs.

Bargaining Power of Suppliers

The cost leader generally operates with margins greater than those of competitors and often tries to increase its margins by driving costs lower.

Among other benefits, higher gross margins relative to those of competitors make it possible for the cost leader to absorb its suppliers’ price increases. When an industry faces substantial increases in the cost of its supplies, only the cost leader may be able to pay the higher prices and continue to earn either average or above-average returns.

Alternatively, a powerful cost leader may be able to force its suppliers to hold down their prices, which would reduce the suppliers’ margins in the process.

Some firms create dependencies on suppliers by outsourcing whole functions. They do so to reduce their overall costs.

They may outsource these activities to reduce their costs because of earnings pressures from stakeholders in the industry. However, outsourcing can create new costs, as suppliers and partners demand a larger share of the value created.

Often when there is such earnings pressure, the firm may see foreign suppliers whose costs are also lower, providing them the capability to offer the goods at lower prices.

Yet, when firms outsource, particularly to a foreign supplier, they also need to invest time and effort into building a good relationship, hopefully developing trust between the firms. Such efforts facilitate the integration of the supplier into the firm’s value chain.

Potential Entrants

A cost leadership strategy creates benefits relative to potential new entrants. Specifically, the presence of a cost leader in an industry tends to discourage new firms from entering the business because a new firm would struggle to attract customers by undercutting the cost leaders’ prices. Thus a cost leadership strategy helps create barriers to entry that protect the firm—and its existing rivals—from new competition.

Through continuous efforts to reduce costs to levels that are lower than competitors, a cost leader becomes highly efficient. Because increasing levels of efficiency enhance profit margins, they serve as a significant entry barrier to potential competitors.

New entrants must be willing to accept less than average returns until they gain the experience required to approach the cost leader’s efficiency. To earn even average returns, new entrants must have the competencies required to match the cost levels of competitors other than the cost leader. The low-profit margins make it necessary for the cost leader to sell large volumes of its product to earn above-average returns. However, firms striving to be the cost leader must avoid pricing their products so low that they cannot operate profitably, even though volume increases.

Product Substitutes

Compared with its industry rivals, the cost leader also holds an attractive position relative to product substitutes.

A product substitute becomes a concern for the cost leader when its features and characteristics, in terms of cost and differentiation, are potentially attractive to the firm’s customers.

When faced with possible substitutes, the cost leader has more flexibility than its competitors. To retain customers, it often can reduce the price of its good or service. With still lower prices and competitive levels of differentiation, the cost leader increases the probability that customers prefer its product rather than a substitute.

Risks of the Cost Leadership Strategy

The cost leadership strategy is not risk-free.

One risk is that the processes used by the cost leader to produce and distribute its good or service could become obsolete because of competitors’ innovations.

These innovations may allow rivals to produce goods or services at costs lower than those of the original cost leader, or to provide additional differentiated features without increasing the product’s price to customers.

A second risk is that too much focus by the cost leader on cost reductions may occur at the expense of trying to understand customers’ perceptions of competitive levels of differentiation.

Imitation is a third risk of the cost leadership strategy. Using their own core competencies, competitors sometimes learn how to successfully imitate the cost leader’s strategy. When this happens, the cost leader must increase the value its good or service provides to customers. Commonly, value is increased by selling the current product at an even lower price or by adding differentiated features that create value for customers while maintaining price.

What Firms Need for Cost Leadership Strategy

Cost leaders tend to share some important characteristics. The ability to charge low prices and still make a profit is challenging. Cost leaders manage to do so by emphasizing efficiency.

As part of the effort to be efficient, most cost leaders spend little on advertising, market research, or research and development.

In developing distinctive competencies, the overriding goal of the cost leader must be to increase its efficiency and lower its costs compared with its rivals. The development of distinctive competencies in manufacturing and materials management is central to achieving this goal.

Many cost leaders gear all their strategic choices to the single goal of squeezing out every cent of costs to sustain their competitive advantage.

Limited Market Segmentation

The cost leader also normally ignores the different market segments and positions its product to appeal to the average customer. This is because developing a line of products tailored to the needs of different market segments is an expensive proposition. A cost leader normally engages in only a limited amount of market segmentation. Even though no customer may be totally happy with the product, the fact that the company normally charges a lower price than its competitors attracts customers to its products.

Economies of Scale

Many cost leaders rely on economies of scale to achieve efficiency. Economies of scale are created when the costs of offering goods and services decrease as a firm is able to sell more items. This occurs because expenses are distributed across a greater number of items.

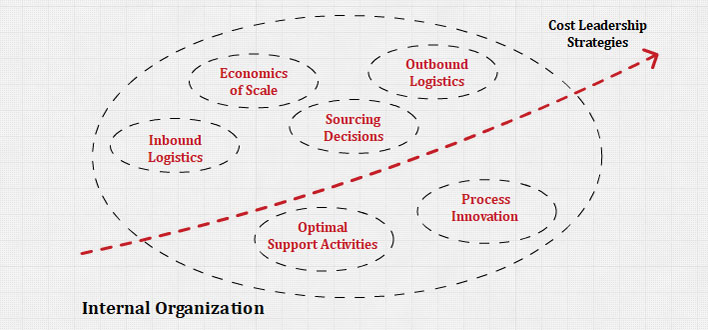

Effective Analysis of Value Chains of the Firms

Firms use value-chain analysis to identify the parts of the company’s operations that create value and those that do not. Companies unable to effectively integrate the activities and functions shown in this figure typically lack the core competencies needed to successfully use the cost leadership strategy.

Efficient Inbound and Outbound Logistics

As primary activities, inbound logistics (e.g., materials handling, warehousing, and inventory control) and outbound logistics (e.g., collecting, storing, and distributing products to customers) often account for significant portions of the total cost to produce some goods and services.

Thus, cost leaders seeking competitively valuable ways to reduce costs may want to concentrate on the primary activities of inbound logistics and outbound logistics.

//value of competitive advantage in logistics

Research suggests that having a competitive advantage in logistics creates more value with a cost leadership strategy than with a differentiation strategy.

Sourcing Decisions

In recent years, firms have developed sourcing strategies to find low-cost suppliers to which they outsource various functions (e.g., manufacturing goods) in order to keep their costs very low, thus successfully implement this strategy.

Many firms choose to outsource their manufacturing operations to low-cost firms with low-wage employees. However, care must be taken because outsourcing also makes the firm more dependent on supplier firms over which they have little control.

Outsourcing creates interdependencies between the outsourcing firm and the suppliers. If dependencies become too great, it gives the supplier more power with which the supplier may increase the prices of the goods and services provided. Such actions could harm the firm’s ability to maintain a low-cost competitive advantage.

Optimal support activities

Cost leaders also carefully examine all support activities to find additional potential cost reductions. Developing new systems for finding the optimal combination of low cost and acceptable levels of differentiation in the raw materials required to produce the firm’s goods or services is an example of how the procurement support activity can facilitate successful use of the cost leadership strategy.

Process Innovations

Process innovations, which are newly designed production and distribution methods and techniques that allow the firm to operate more efficiently, are critical to the successful use of the cost leadership strategy.

Flexible Manufacturing and Efficient Materials Management

Companies pursuing a low-cost strategy may attempt to ride down the experience curve so that they can lower their manufacturing costs.

Achieving a low-cost position may also require that the company develop skills in flexible manufacturing and adopt efficient materials-management techniques. Consequently, the reduction of operating costs of manufacturing and materials management functions are the center of attention for a company pursuing a cost-leadership strategy, and the other functions shape their distinctive competencies to meet this objective. For example, the sales function may develop the competency of capturing large, stable sets of customers’ orders.

This, in turn, allows manufacturers to make longer production runs and so achieve economies of scale and reduce costs. The human resource function may focus on instituting training programs and compensation systems that lower costs by enhancing employees’ productivity, and the research and development function may specialize in process improvements to lower manufacturing costs.

Resources

Further Reading

- Michael Porter’s Generic Cost Leadership Strategy Explained (anthonysmoak.com)

- Cost Leadership & Competitive Advantage (smallbusiness.chron.com)

- How To Create a Cost Leadership Strategy (indeed.com)

- Cost Leadership – Definition, Examples, & Strategies (feedough.com)

- Cost leadership: Clarification, Strategies and its Examples (insighttycoon.com)

- Cost Leadership Strategies for Small Business (thebalancesmb.com)

- Cost Leadership – Definition, Strategies, Examples & Advantages (marketingtutor.net)

Related Concepts

- Business-Level Competitive Strategies

- Differentiation Strategy

- Focus Strategy

- Integrated Best Cost Strategy

References

- Hitt, M. A., Ireland, D. R., & Hoskisson, R. E. (2019). Strategic Management: Concepts and Cases: Competitiveness and Globalization (MindTap Course List) (13th ed.). Cengage Learning.

- Hill, C. W. L., & Jones, G. R. (2011). Essentials of Strategic Management (Available Titles CourseMate) (3rd ed.). Cengage Learning.

- Mastering Strategic Management. (2016, January 18). Open Textbooks for Hong Kong.

- Wheelen, T. L. (2021). Strategic Management and Business Policy: Toward Global Sustainability 13th (thirteenth) edition Text Only. Prentice Hall.